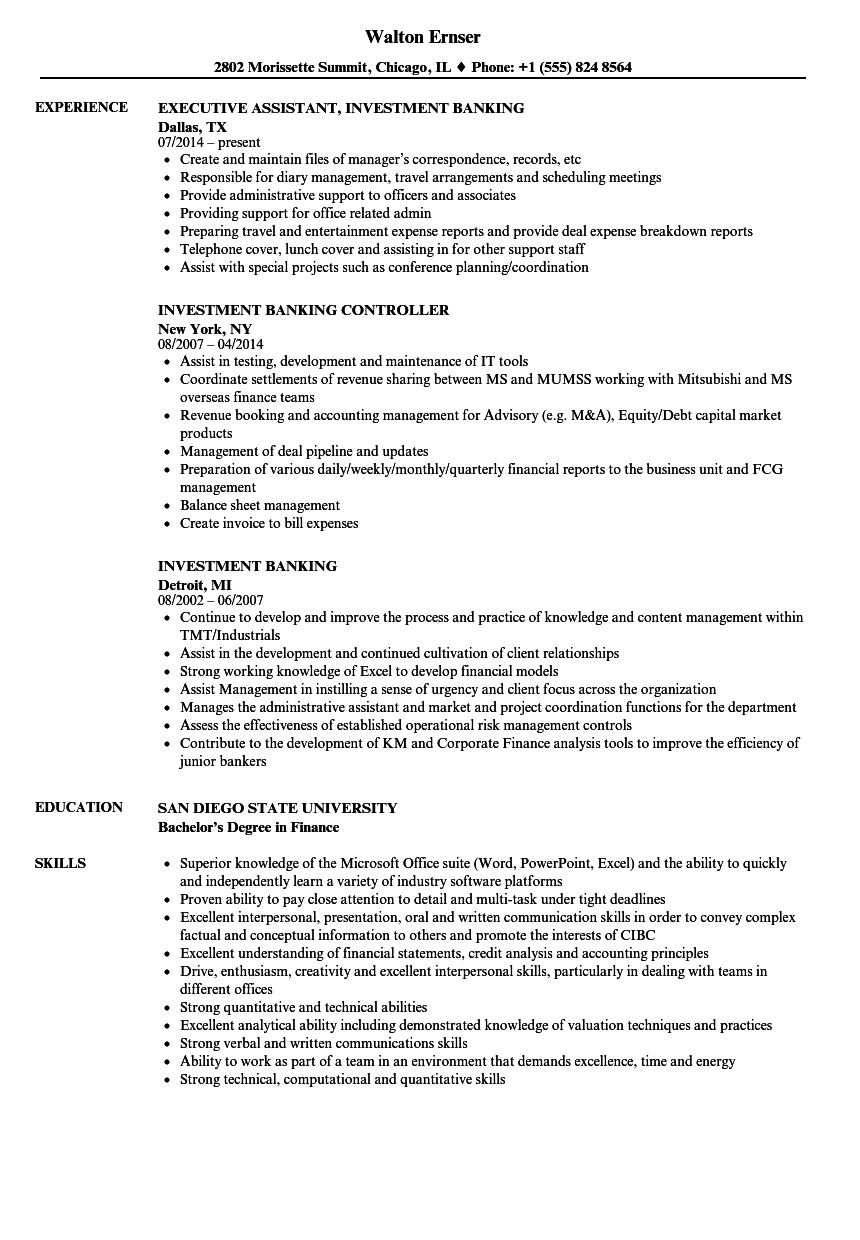

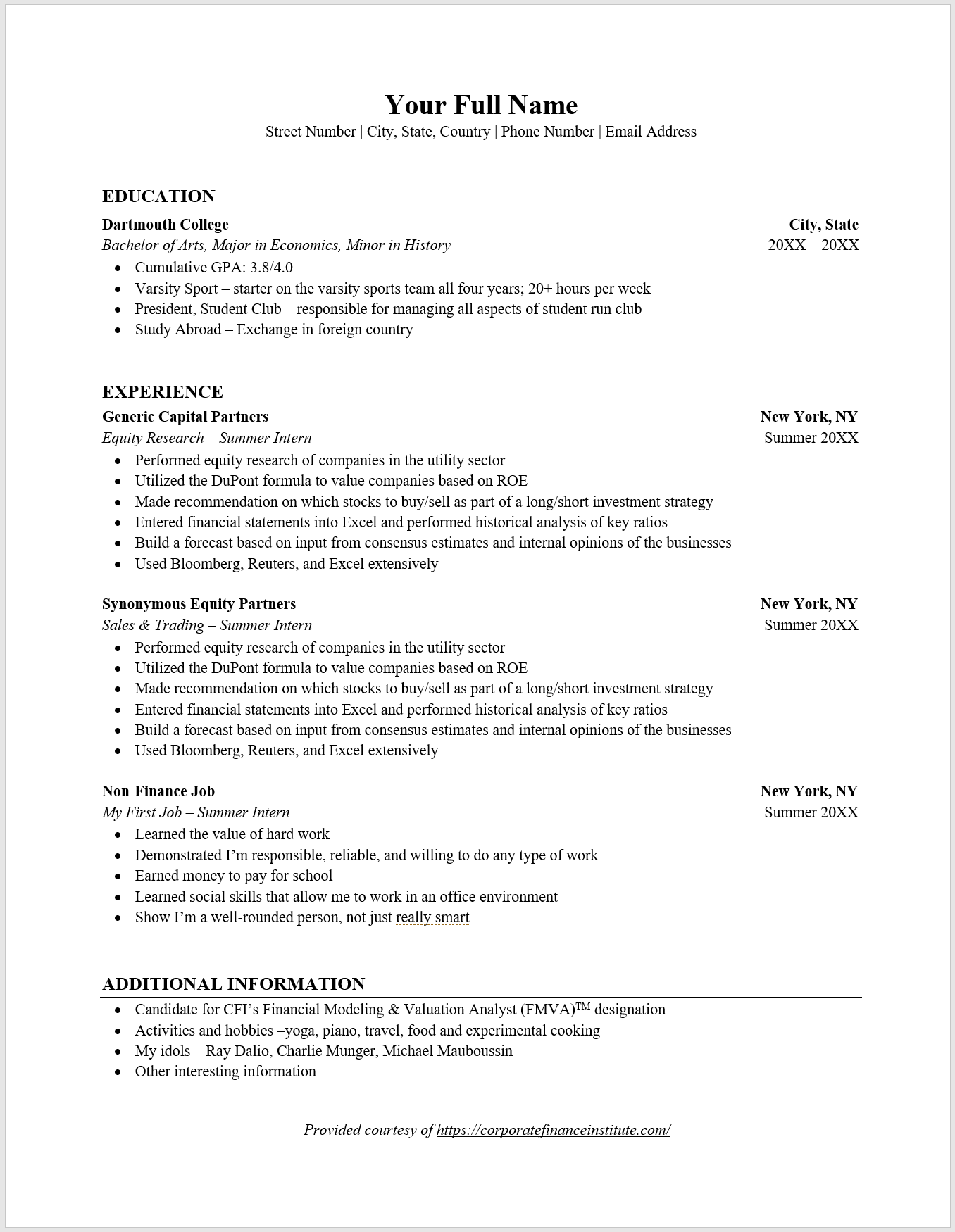

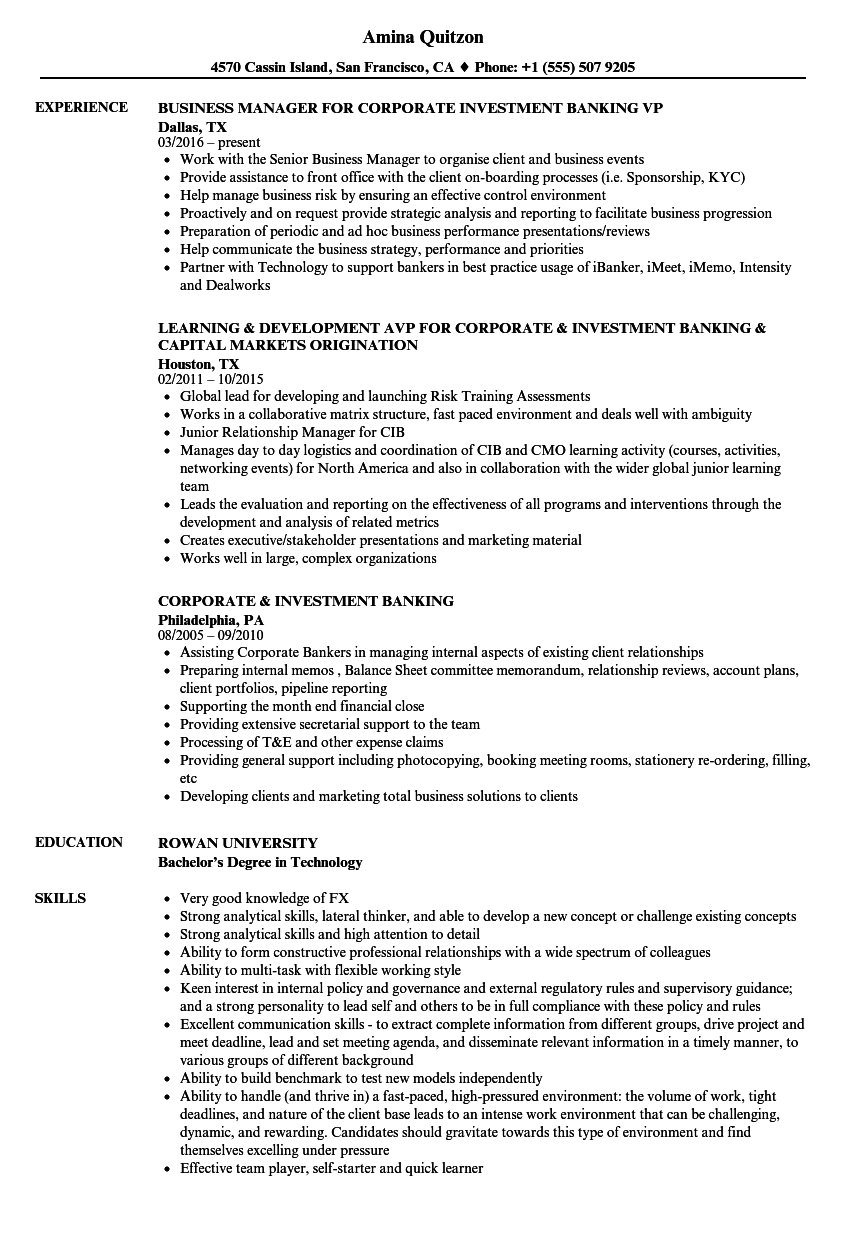

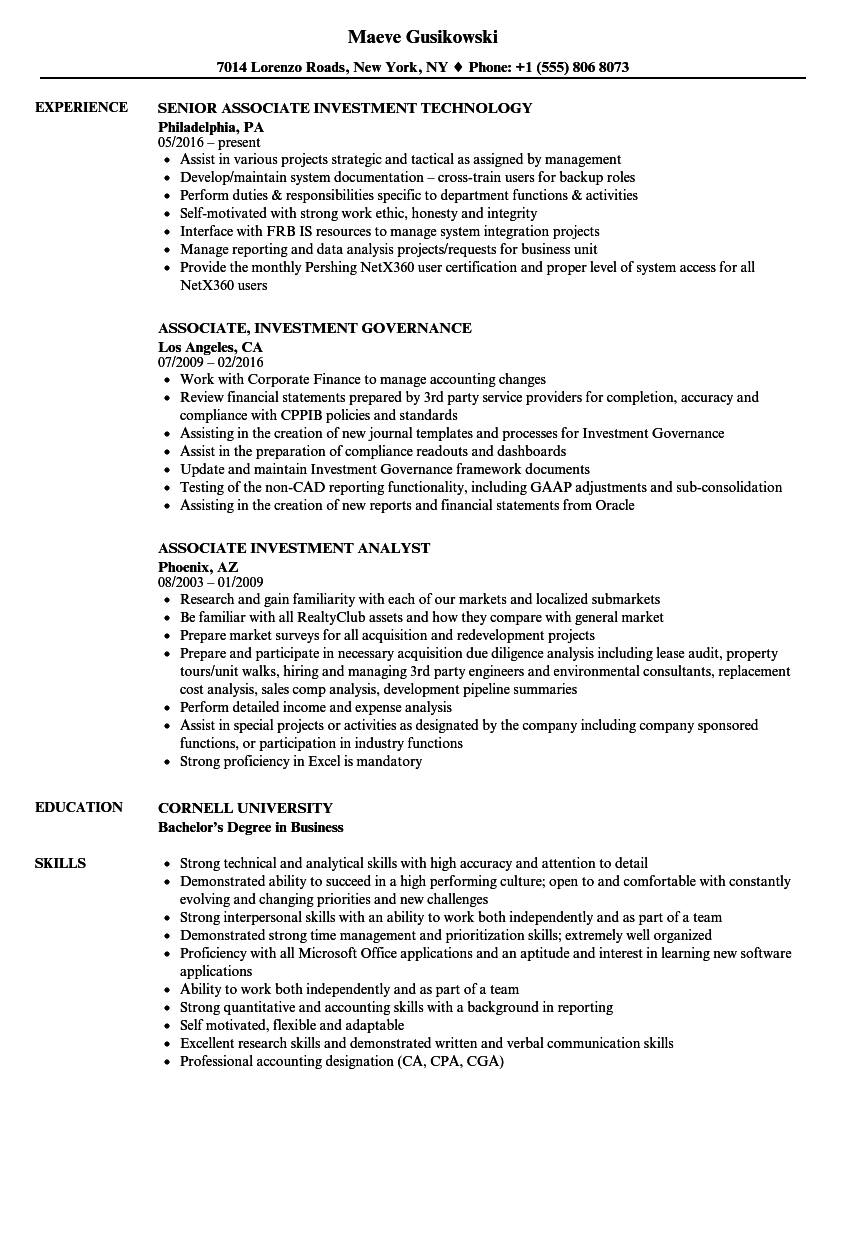

Investment Banking Associate Resume

Its the document bankers look at to decide whether to invite you to an interview.

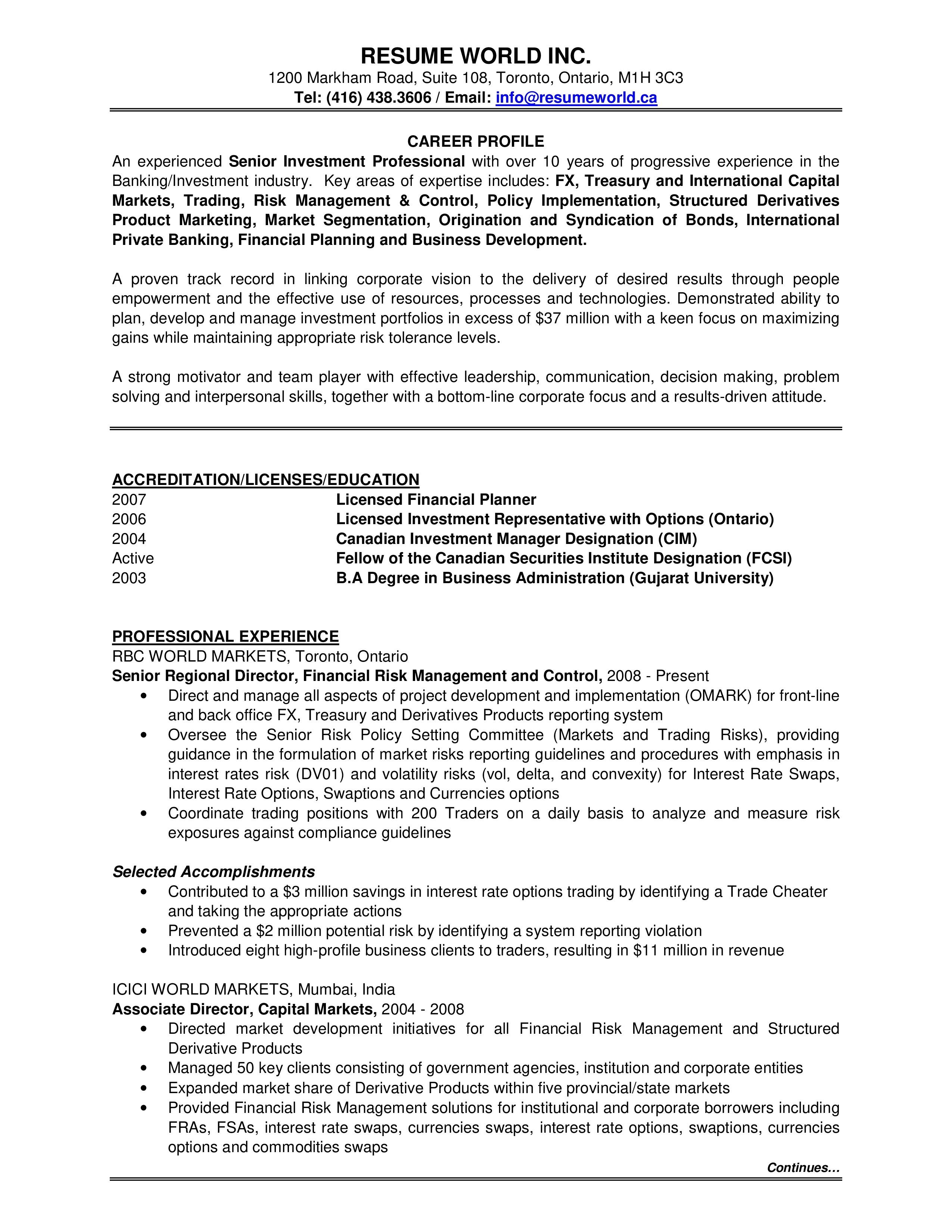

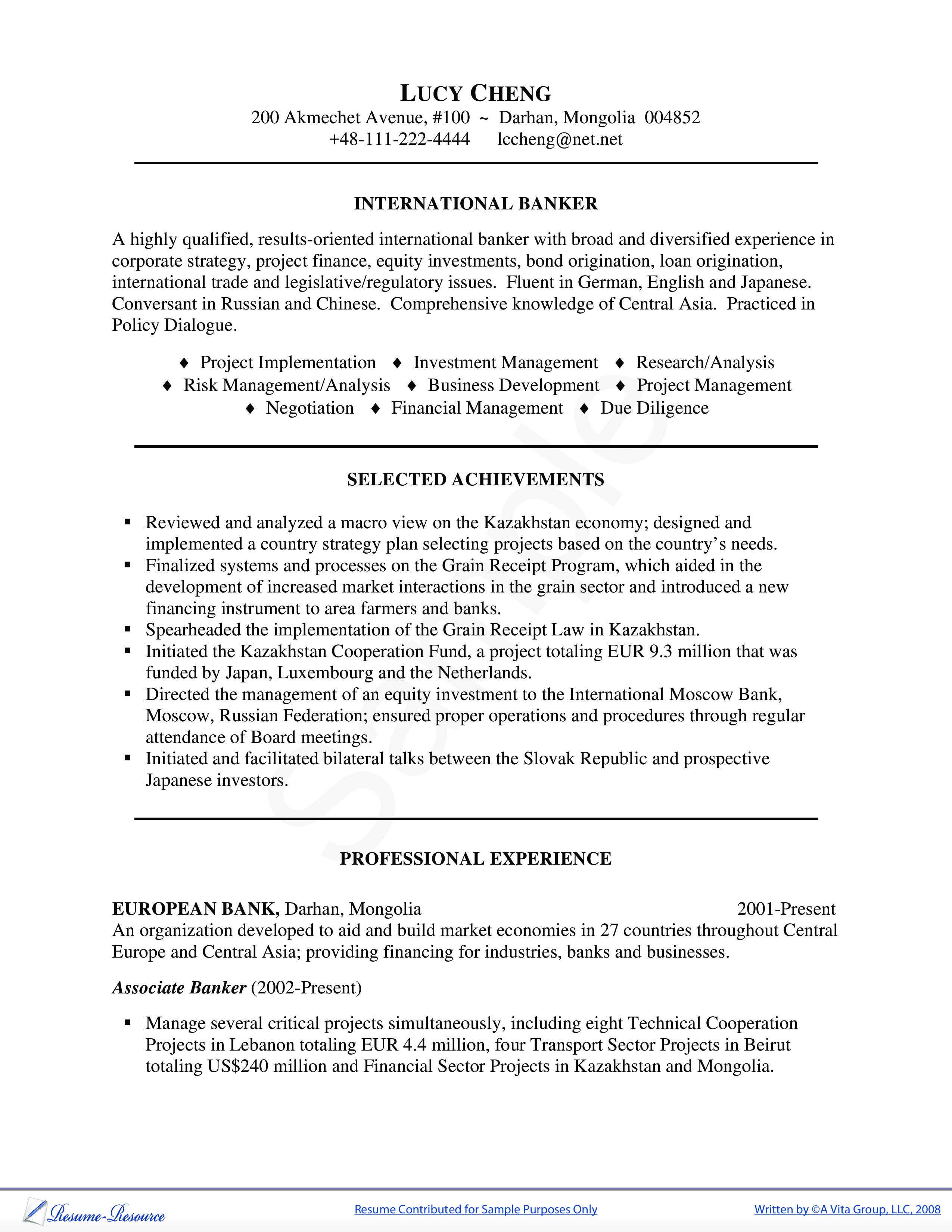

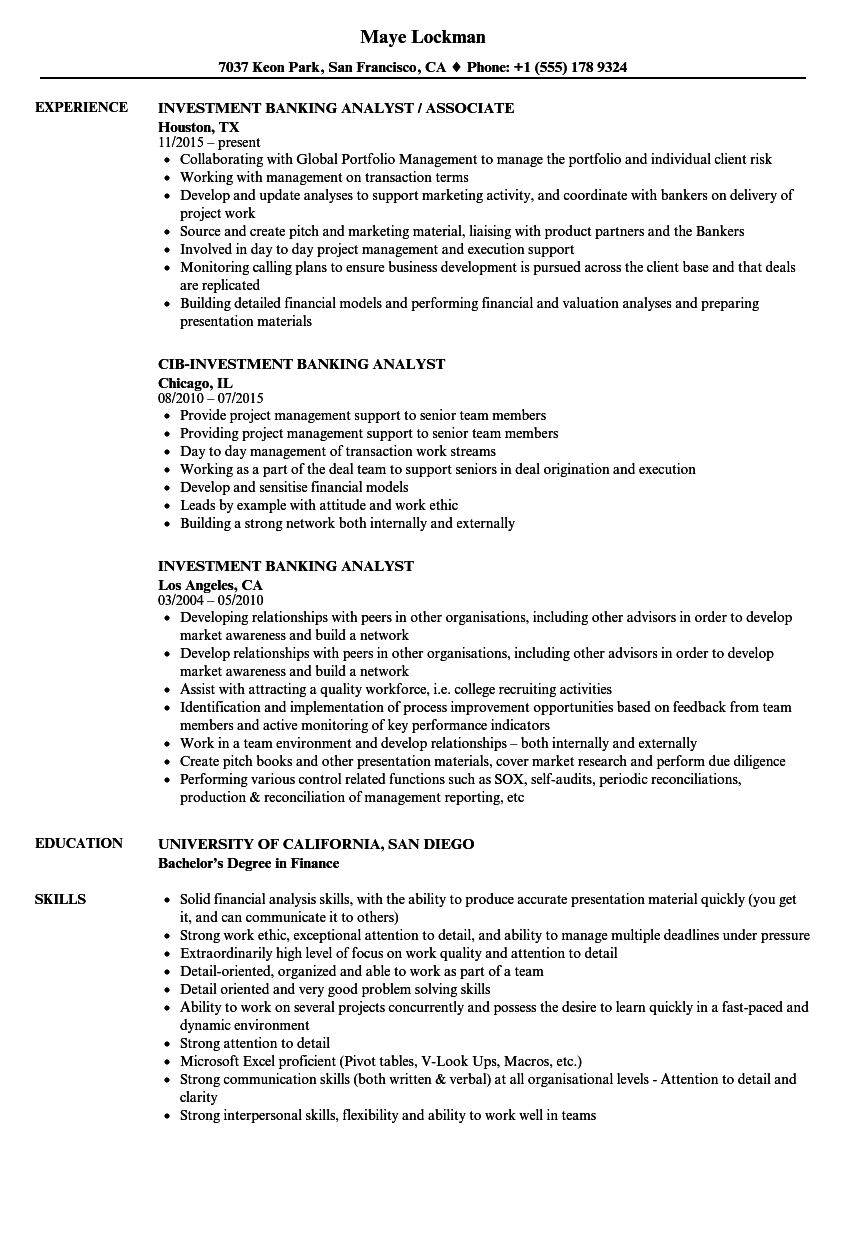

Investment banking associate resume. Secure the interest of recruiters and hiring managers. Completed more than 4 billion of financial transactions grown a new business unit from 0 to 250 MM of revenue and provided financial leadership to an enterprise with 30 manufacturing facilities. Let companies know youre the right choice for the job by submitting a competent and considered resume.

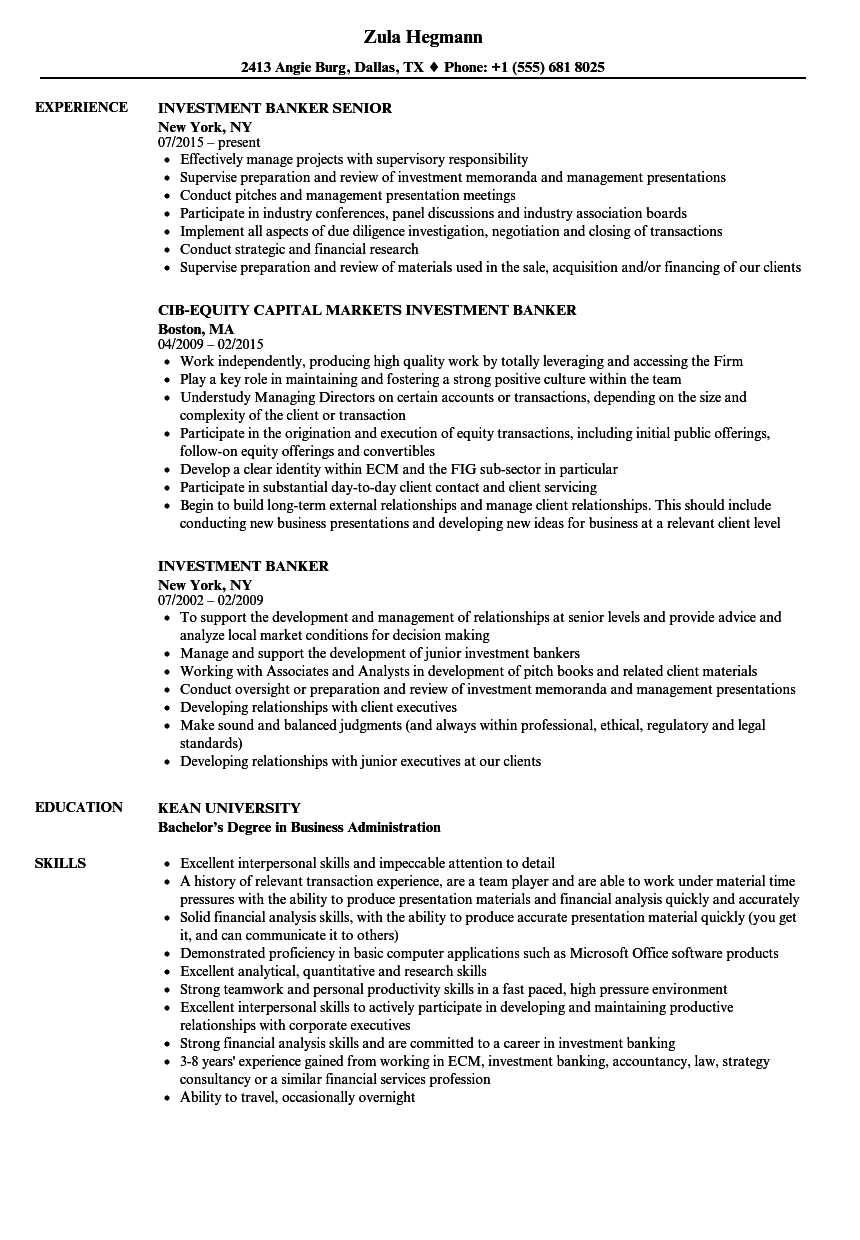

Partnered with Finance Analysts during the implementation of assets into the accounting system and maintained communication with borrowers directly regarding their loans. An Investment Banking Associate initiates strategic financial transactions in an attempt to make a profit for their company. Leading resume editing service specifically targeted towards investment banking private equity hedge.

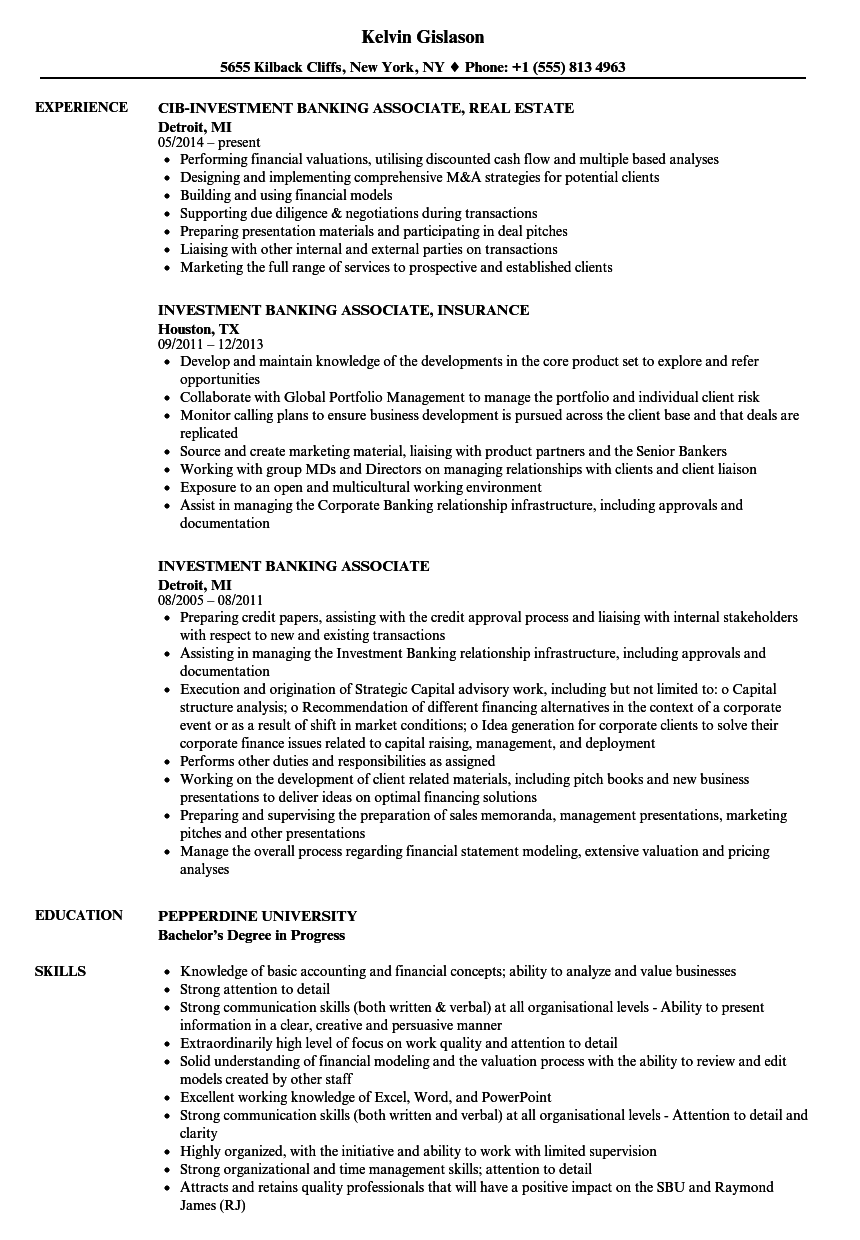

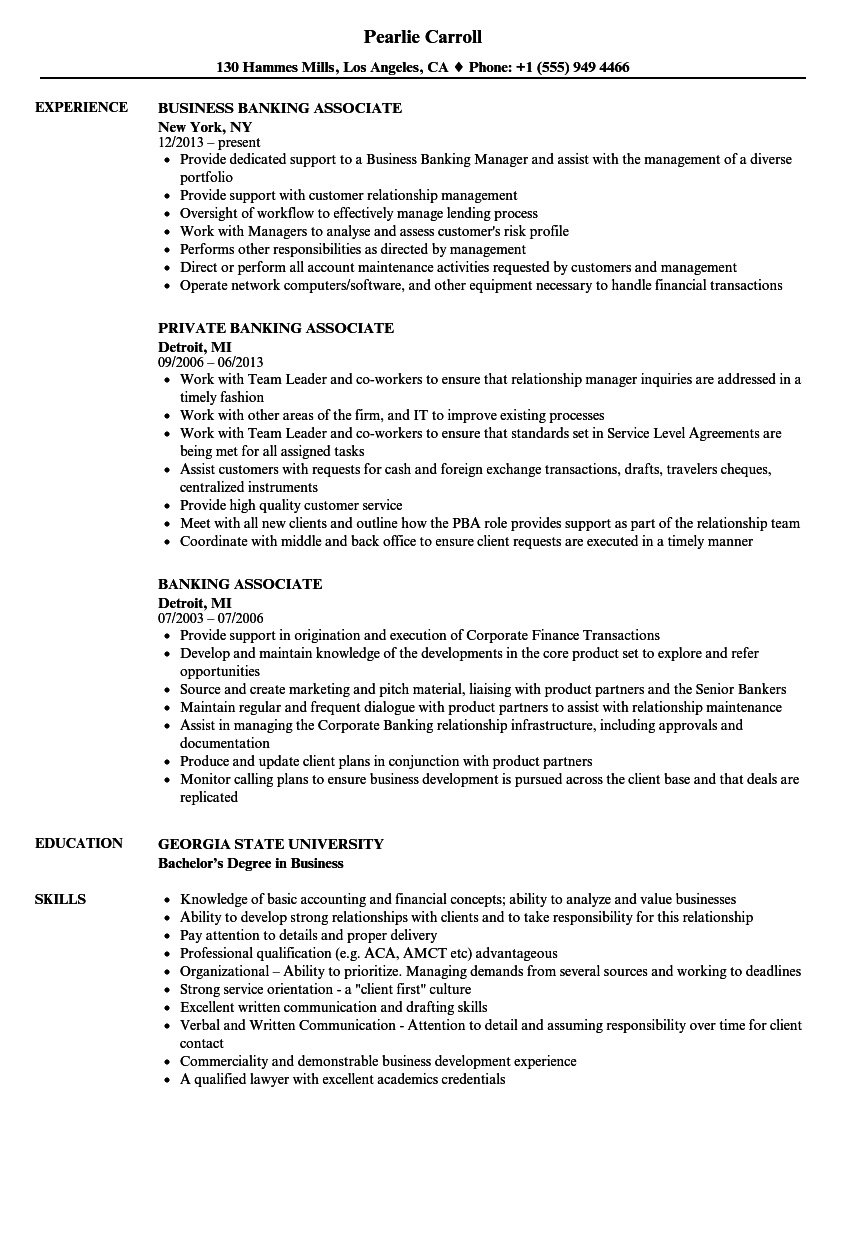

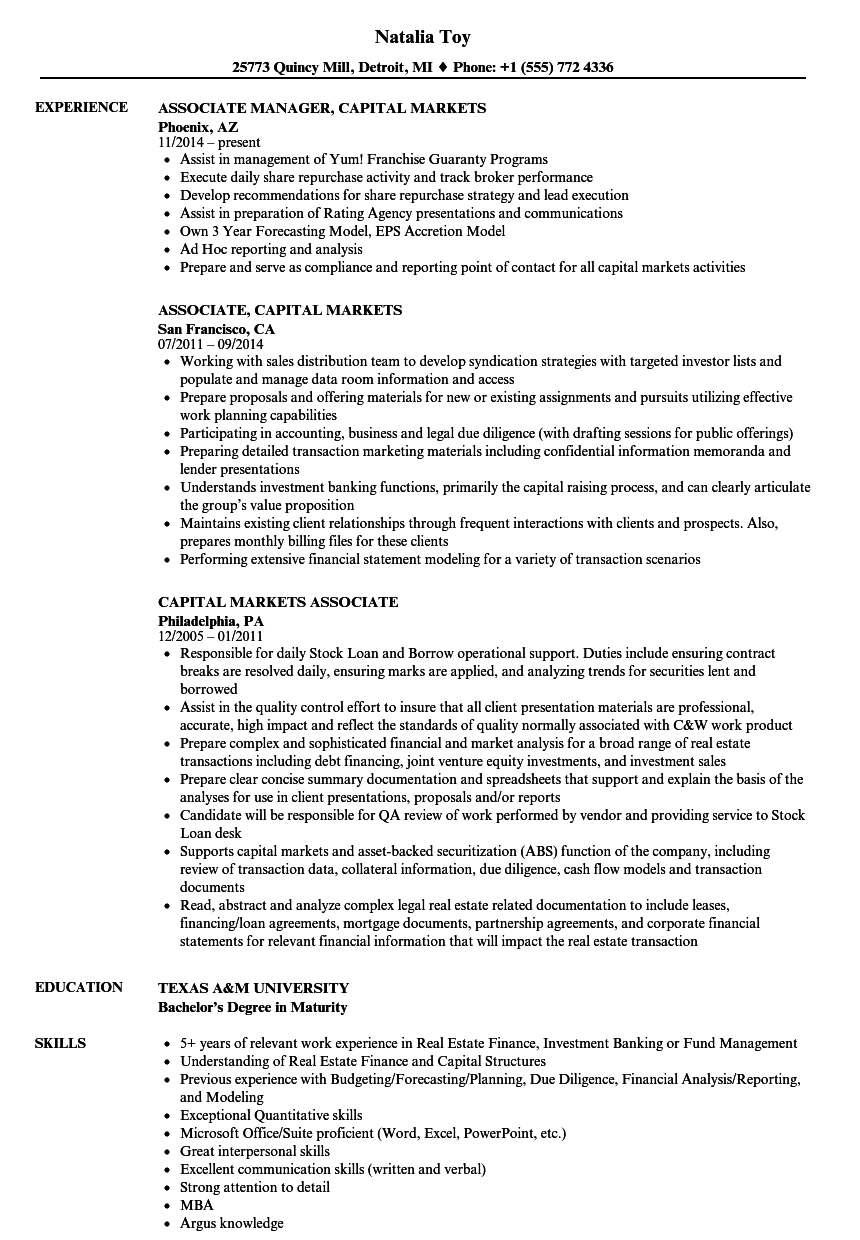

Essential duties of an Investment Banking Associate include coordinating clerks preparing cash flow models and drafting memorandums and other communications with clients and investors. An investment banking associate position with a multi-national bank where my four years of experience in generating financial analysis handling administrative tasks dealing with clients and knowledge of project management will help achieve growth and build revenue for the establishment. Investment Banking Associate Company Name City State.

Investment Operations Associate 122013 to Current. Researched beneficial investment opportunities and made recommendations to senior management. Supervise junior staff and target areas for their development.

How to Spin Your Own Trading Experience. Executed financial due diligence and created a valuation model to establish enterprise value and purchase price. Release the WSO resume template for free to the public.

Whether youre applying for an analyst or an associate position these are absolutely critical to follow. In the Investment Banking Analyst and Associate-level recruiting processes the resume plays a disproportionately important role. Two or more years of transaction-related experience including a significant amount of MA transactions preferably at an investment bank.